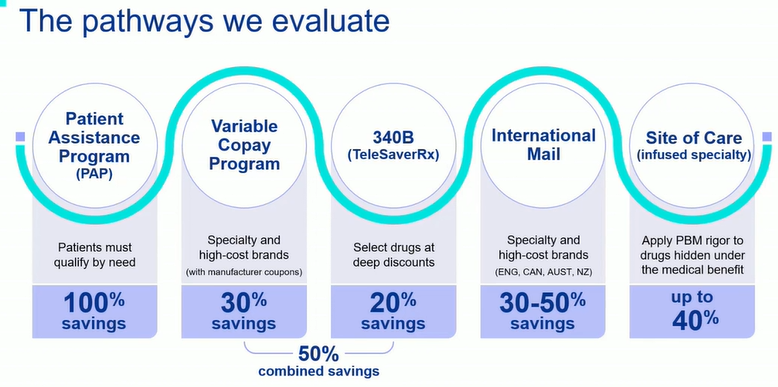

How can your company reduce pharmacy costs while providing the best care and service to employees? Our PBM model consistently delivers high value and significant savings to clients. While each element of our program produces savings for clients, the savings are maximized when all programs are implemented. As each pathway targets different savings opportunities. In nine months, our client achieved $54K in savings through clinical management of the various pathways. The analysis was conducted for our client that has 86 lives and a total of 105 members.

Employee Benefit Advisors has the expertise to evaluate and work with PBMs. – EBA provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

The No Surprises Act, a ban on surprise medical bills, will take effect beginning in 2022.

The No Surprises Act, a ban on surprise medical bills, will take effect beginning in 2022.