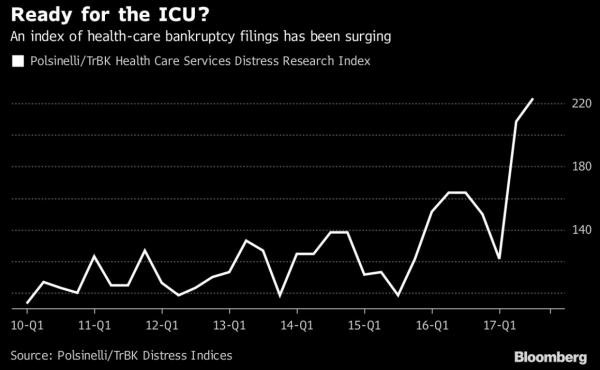

Health-care bankruptcy filings have more than tripled this year according to Bloomberg, and an index of Chapter 11 filings has reached record highs (industry companies with more than $1 million of assets). It’s expected that for 2018 the trend will increase; hospitals and other medical companies are likely to restructure their debt or file for bankruptcy.

How is Obamacre contributing to the hospital failures? Obamacare’s architects were so certain their legislation would completely eliminate uninsured citizens in the U.S., they decided to offset the costs of the “Affordable Care Act” by eliminating subsidy payments to hospitals that had previously been used to cover losses from treating uninsured patients. Regulatory changes, technological advances and the rise of urgent-care centers have created a “perfect storm” for health-care companies.

Content source, ZeroHedge by Tyler Durden.

Men don’t go to the doctor unless their arm or leg is falling off or they are dying. Consequently they are a major reason for the large

Men don’t go to the doctor unless their arm or leg is falling off or they are dying. Consequently they are a major reason for the large