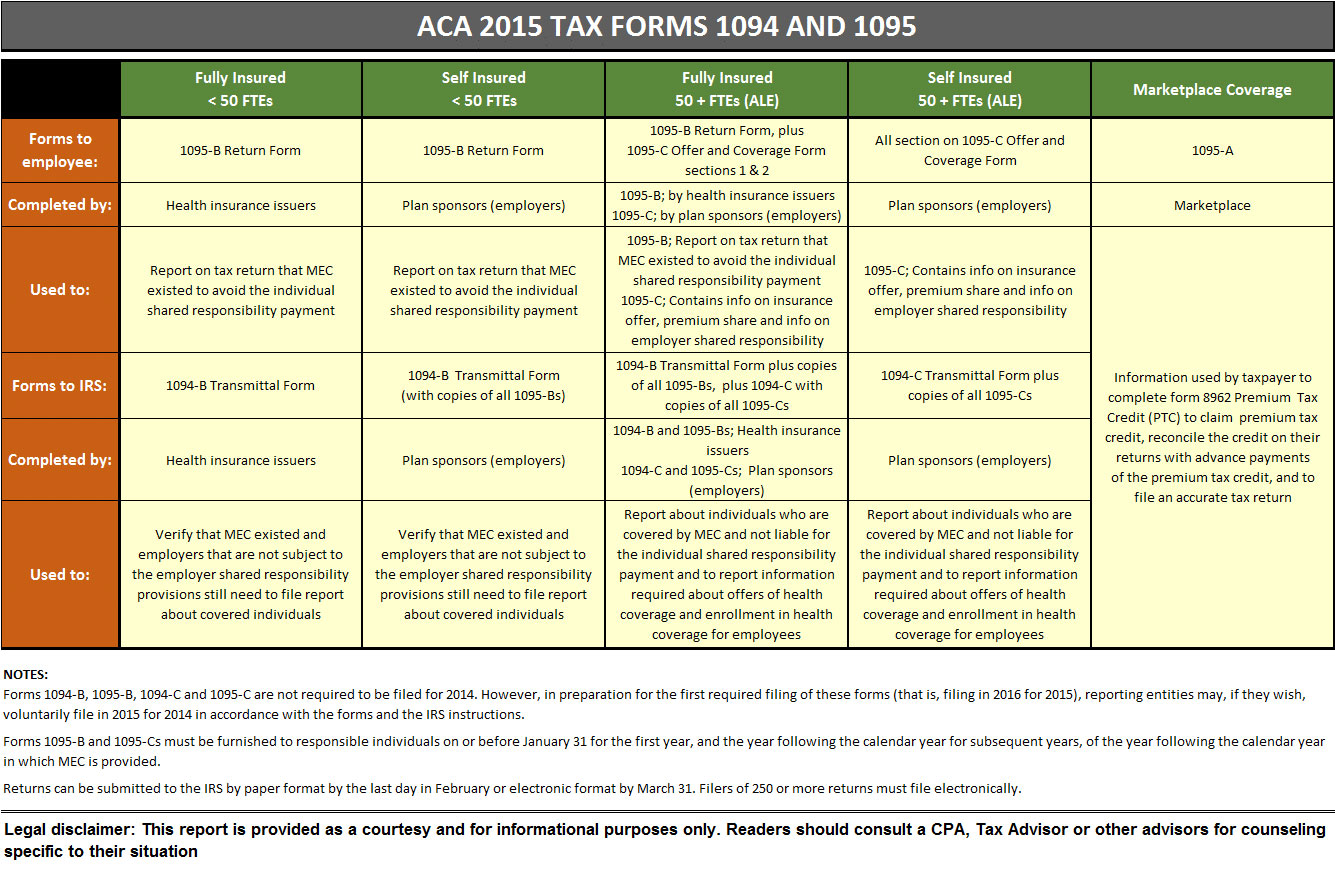

The ACA forms chart is voluntary for employers that wish to file in 2015 for 2014. The return and transmittal forms are to be filed with the IRS on or before February 28 (March 31 if filed electronically) of the year following the calendar year of coverage.

Here’s the IRS link for complete instructions.

http://tinyurl.com/mgzhyoc

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

Leave a Reply