The following was posted on the wall when I visited my dentist recently. – Glad to report my teeth and gums are healthy.

Periodontal infection increases risk

| Heart disease Infectious endocarditis Carotid artery stenosis Stroke Diabetes Rheumatoid arthritis Mouth and throat cancer Pancreatic cancer Colon cancer Kidney infection lung infection/COPD |

Low fertility in men Erectile dysfunction Brain abscesses Cognitive dysfunction/ Alzheimer’s Infectious mononucleosis Pre-term babies Yeast infections Multiple sclerosis Osteoporosis |

periodontal (adjective) of, denoting, or affecting the gums and other tissues surrounding the teeth: periodontal disease

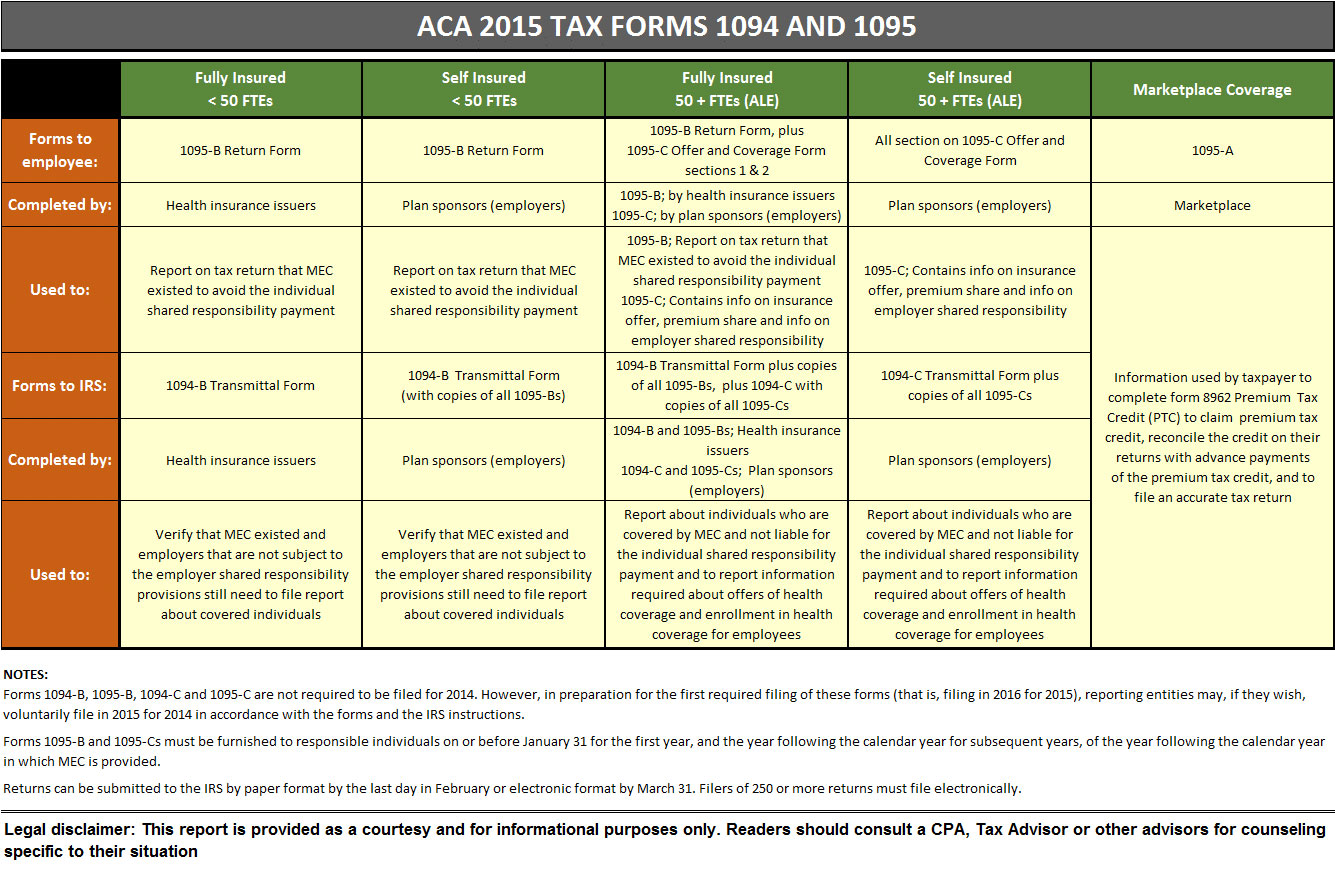

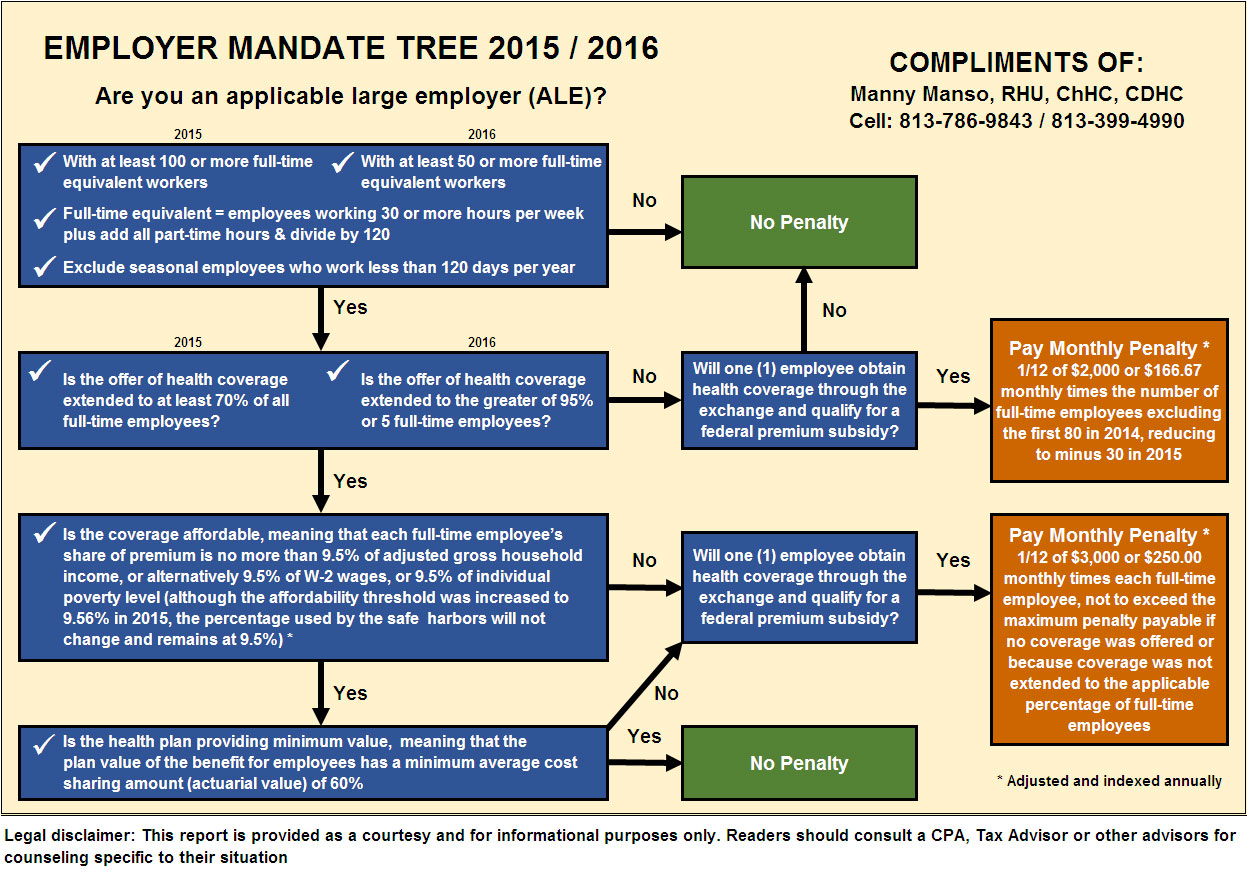

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.