Anywhere between 40 and 75 percent of drugs are ineffective for individual patients. That means a large portion of patients may not only be wasting their money—but they may not be receiving the treatment or the results they seek.

Pre-Active medicine is a new diagnostic discipline that uses genetic insights to help prevent adverse drug reactions, misdiagnosis or other negative consequences of inadequate medical discovery.

CompanionDx™ is one of the only providers of both pharmacogenomics evaluations and cancer companion diagnostic testing. When used separately or in conjunction, these two types of tests are giving physicians the resources they need for more comprehensive patient treatment profiles—and that means more certainty when it comes to effective therapeutic decisions.

Tests include:

Pharmacogenomics testing

Cancer companion diagnostics testing

Colorectal cancer screening

NextGen Sequencing testing (in development)

You’ll receive easy-to-read test reports within 3-7 days.

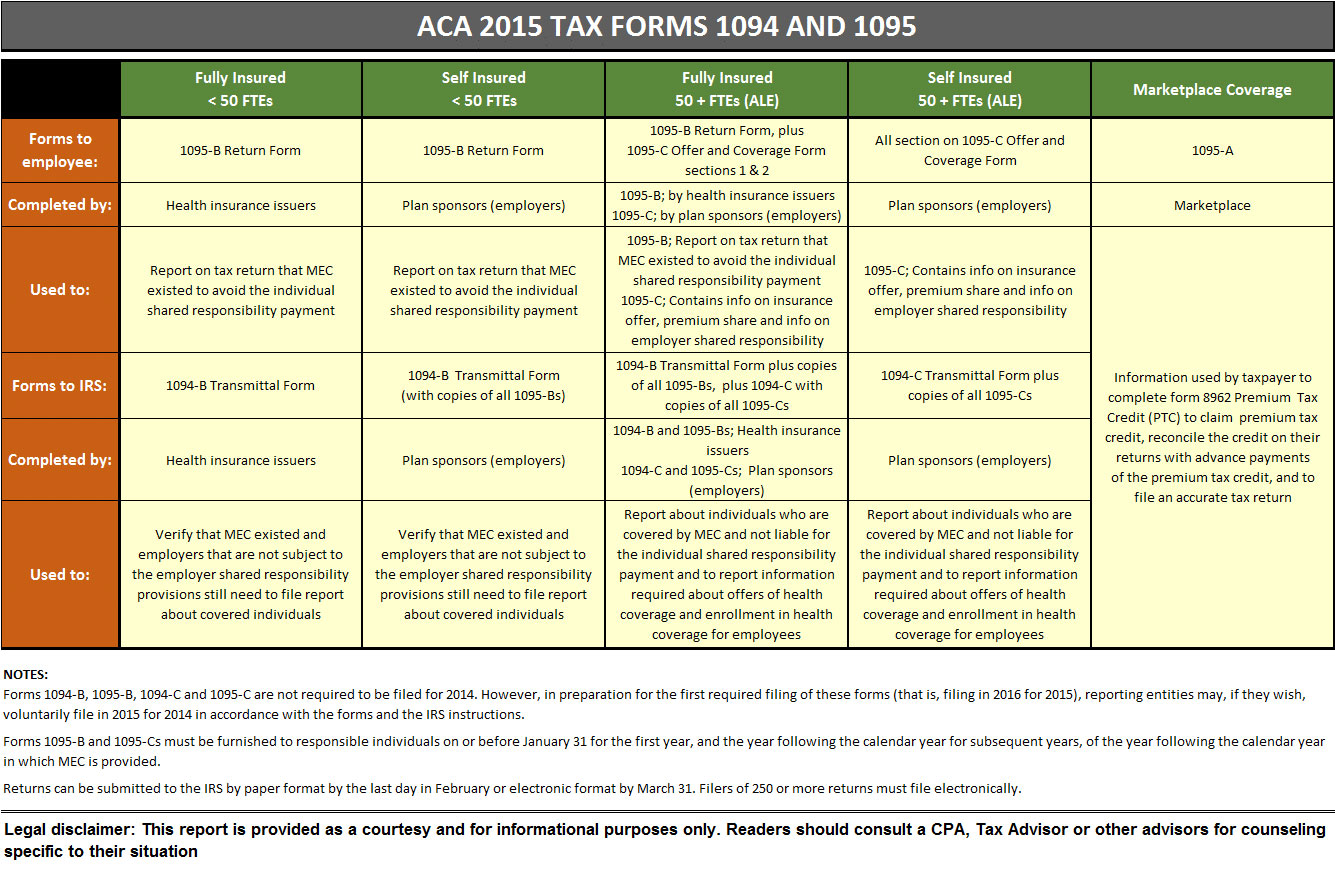

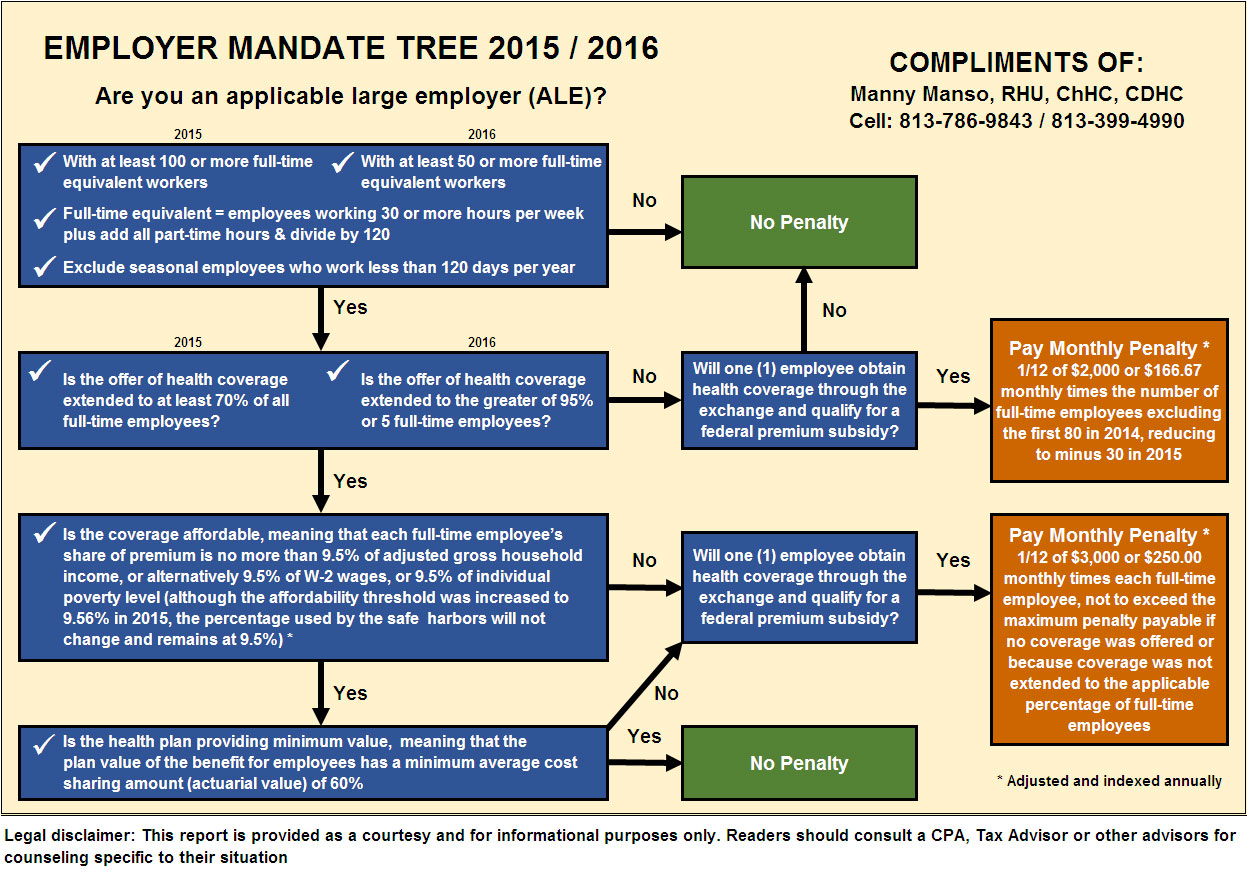

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.