The DOL issued a new rule that allows employers to join together to offer group health insurance coverage. The rule allows association health plans to be formed based on industry or geography, such as by state, city, county, or multi-state metropolitan area.

The association health plans will be subject to the large group coverage nondiscrimination rules. These rules prohibit discrimination based on a health factor or within groups of similarly situated individuals. The rules however do provide plans to impose different eligibility provisions and costs based on employment-based classifications, full-time versus part-time.

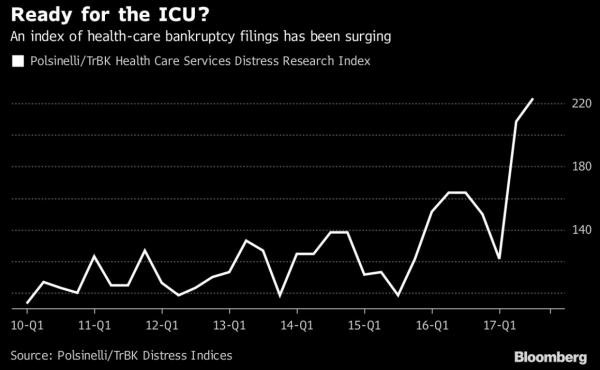

These insurance plans would not be subject to requirements under the Affordable Care Act (ACA) which included mandatory coverage for a set of 10 essential health benefits, such as maternity and newborn care, prescription drug costs and mental health treatment. However, they are expected to be considerably less expensive than Obamacare plans. The warning from health providers, insurers and medical groups is the plans could drive up premiums by siphoning off healthy consumers who want cheaper coverage, leaving behind a sicker patient pool with higher medical costs in Obamacare plans.

States and the Federal government would share regulatory oversight of the plans, with states retaining their current authority.

Click here for more information from the DOL.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.