This is the best explanation I have heard. Includes great visuals.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

This is the best explanation I have heard. Includes great visuals.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

If you find yourself asking questions like:

2nd.MD will get you help and answers.

Here are some quick stats:

2nd.MD provides support for any condition. Your support starts with a Care Team Nurse. Within days, 2nd.MD will collect your pertinent medical records and imaging and connect you via phone or video to a world-class specialist, uncovering all the possibilities and taking control of your health outcome through local and national in-network referrals.

Service is at no cost to if you are enrolled with a participating organization/employer as part of your benefits package. Many people have their service through their insurance carrier and don’t even know it! The benefit of 2nd.MD is also available to individuals. Contact them directly for pricing.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

Group health insurance premium are expected to rise 15-18% in 2019 and Telemedicine can be an important cost containment tool, for both employer and employee.

In a study of 17,000 telemedicine participants, hospital admissions dropped by 30% and doctor visits were reduced by 60%, for a savings of 45% in unnecessary doctor and emergency room visits. The American Medical Association states that 70% of doctor visits can be handled over the phone, and 50% of the emergency room visits are non-emergencies. Telemedicine’s savings in claim costs range from $300 for a single employee to more than $1,000 per year for a family of 4.

Telemedicine provides 24/7 medical access to employees as part of their benefit package. Advances in communication technologies make accessing professional medical opinions easier. This is particularly important if the network is strictly local, employees live in rural areas, or employees are worried about access to doctors while traveling.

In addition to the obvious convenience – patients/employees do not have to take time away from work for a medical appointment, sitting in the doctor’s waiting room, eliminating travel time – patients/employees have increased access to medical experts in many fields. Telemedicine puts the employee in touch with US Board Certified physicians in their state to treat common ailments; cold/flu, sinus infections, allergies, pink eye, etc.

What can employers do? – Employee Benefit Advisors recommends companies build a communication program to educate employees. In addition to informing employees the services that can be accessed via telemedicine be sure to include instructions on downloading your health insurance carrier’s app and login.

Interestingly, a bill submitted in New York proposes creating a task force to study how telehealth and telemedicine might help employees in workers comp. The task force would examine how connected health technology could improve outcomes for workers on worker’s comp, increase access to care providers and enable those providers to improve compliance with worker’s comp guidelines. The committee would also explore how telehealth and telemedicine could help employers and reduce fraud.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

Concerned about being at risk for colon cancer? Don’t like the idea of a colonoscopy? You may want to consider learning more about Cologuard, an at-home testing kit that screens you for colon cancer.

What it is.

Cologuard is a noninvasive, prescription-only test. It’s designed for adults 50 years or older who are at average risk for colon cancer.

What it’s not.

Cologuard is not a replacement for diagnostic or surveillance colonoscopy in high risk individuals. If you have a medical history that includes colon cancer, polyps, or related cancers, it isn’t right for you.

How to tell if it’s for you.

The first step is to discuss the Cologuard testing kit with your healthcare provider. Once your healthcare provider approves the prescription, your kit can be ordered. It will be delivered right to your door.

How effective is it?

In 10,000 testing cases, Cologuard screenings discovered 92% of colon cancers and 42% of high-risk pre-cancers. Since both false positives and false negatives occur, Cologuard encourages positive-results patients to follow-up with a diagnostic colonoscopy. Negative-results patients are encouraged to participate in additional screenings at intervals.

Will your insurance cover it?

Preventative Care / Screenings are covered at no cost under the Affordable Care Act. Cologuard is covered by most insurers with no co-pay or deductible for eligible patients (ages 50-75; at average risk for colon cancer; without symptoms). Cologuard is covered by Medicare and Medicare.

If your insurance provider doesn’t cover it or only covers part of the costs, Cologuard’s appeal department will assist you in creating an appeal letter to send to your insurance company.

The Cologuard screening is FDA-approved and has been in use since 2014.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

Meet Jeanette, she has lupus. (A chronic autoimmune disease in which the body’s immune system becomes hyperactive and attacks normal, healthy tissue. This results in symptoms such as inflammation, swelling, and damage to joints, skin, kidneys, blood, the heart, and lungs.)

(Jeanette mentions PatientsLikeMe in her video. PatientsLikeMe is a free website where people can share their health data to track their progress, help others, and change medicine for good. It’s an online community with over 2,500+ conditions.)

Now, the rest of the story.

Jeanette says she turned to dietary changes when she stopped taking Plaquenil due to severe side effects, including retina damage. She started logging her food intake for a few weeks, she noticed how some of her favorite foods were causing issues ranging from stomach pains to full inflammation. That’s when she started paying close attention to what her body was telling her and realized she needed to do something about it.

Jeanette didn’t go on any specific diet at first, she started eliminating certain foods like sugar (which was causing major fatigue and pain), garlic (causing major inflammation in her knees), eggplants (fatigue and pain in her feet), bean sprouts (stomachaches) and alfalfa (full inflammation and full flare) — some of the known foods that lupus patients shouldn’t eat [learn more at lupus.org].

Then Jeanette noticed how meat was causing fatigue and noticed inflammation directly in her knees. She gave up red meat for two weeks, felt good and noticed a reduction of pain. Then she gave up chicken the following two weeks and felt even better. “It was so amazing that I decided to give it up for good.” After the first few months without meat, my doctor started noticing my blood work was improving drastically, so she began reducing her medications since she was no longer flaring or feeling pain. After a full year she reduced all medications to zero and even stopped infusions.

(Everyone is different, so these foods and dietary changes may not affect you the same way. Talk with your doctor or a registered dietitian about finding foods that work for you.)

With a click of a button, patients have access to their health history from any mobile device and share it with physicians or patient care members.

HealthKos is a solution which shares information via automated interactions, within the patient care network. The processes optimizes medication use and care coordination. Health data points can be recorded and monitored for around the clock assistance. This includes all vital signs, weight and BMI, health wellness activities, and a complete updated medication list. The stored data on the HealthKOS platform allows for automated and timely communication with the health care team and family members to provide critical help in time of need, thus preventing an urgency from becoming an emergency, or even worse, an emergency from becoming a catastrophe.

HealthKOS empowers the patient to monitor their health through Bluetooth enabled devices and empowers the health care team to monitor patient progress outside the physician’s office, leading to timely interventions and preventing unnecessary disease progression and hospitalizations.

“Better Engagement → Leads to Better Compliance → Better Quality of Care”

HealthKOS, developed by doctors, allows the workflow to become patient centric, easy to use and provides lower cost quality health-care.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

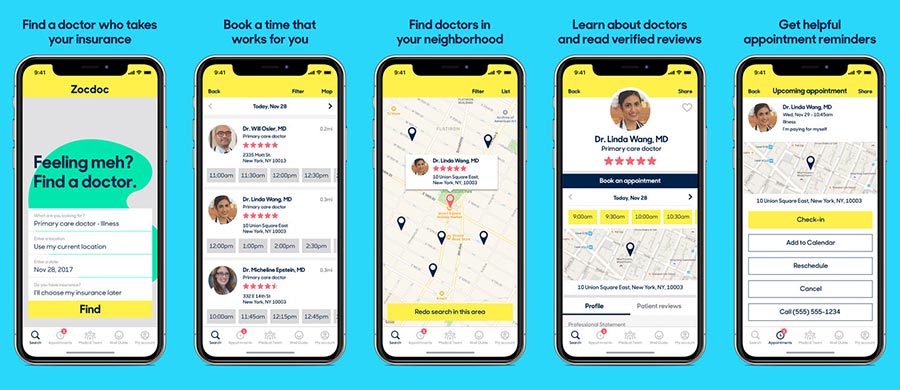

New to the area and don’t know anyone? Download the app and within 2 minutes find the perfect PCP, Specialist or Pediatrician. Zocdoc is the beginning of a new healthcare experience. Find doctors you love, read real reviews, book appointments instantly, and more with this award-winning app.

Features

• See neighborhood doctors in your insurance network

• Book appointments with over 50 different medical specialties, including dentists, primary care doctors, allergists, OBGYNs, dermatologists, family doctors, urologists, psychologists, ophthalmologists, podiatrists, optometrists, pediatrists and more

• Read verified reviews from other patients

• See open appointment times and book instantly and keep track of your medical calendar. No phone calls necessary, even for same day bookings!

• Algorithm lets you search by specialties and conditions, like diabetes, obesity/weight loss, cancer, yellow eyes, bleeding, cysts, sore throat and more.

• Check in on the app to complete your paperwork and save time at the office

• Receive text reminders before your appointments

More Features

• Find doctors near your location with a convenient map

• Read doctors’ professional statements, learn about their education, and see what languages they speak

• Keep track of your physicians and easily schedule follow-up appointments from your Medical Team homepage

• Stay on top of important checkups with Wellness Reminders

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

With Accumulator Programs the manufacturer’s payments no longer count toward a patient’s deductible or out-of-pocket maximum. Employers and health plans could potentially save big money because accumulators shift a majority of drug costs to patients and manufacturers.

Normally, a manufacturer’s payments from a copay program count toward a patient’s deductible and annual out-of-pocket maximum. Once these annual limits are reached, the plan pays for all subsequent prescriptions.

Problem is the Accumulator Programs will lower a plan’s drug spending by discouraging the appropriate utilization of specialty therapies and reducing adherence.

You may recognize Copay Accumulator by other names; UnitedHealthcare uses the term “Coupon Adjustment: Benefit Plan Protection program,” Express Scripts uses the term “Out of Pocket Protection program.” Choose your poison, both are misleading, especially to the patient.

For a deep dive into the potential impact of CoPay Accumulator Programs I recommend reading the article (link below) from Adam J. Fein, Ph.D. (Drug Channels) that highlights many potential concerns to Copay Accumulator Programs. Copay Accumulators: Costly Consequences of a New Cost-Shifting Pharmacy Benefit

Are you contracting with a large PBM because they offer great discount? You might want to rethink your strategy and look to smaller PBMs with complete transparency. Perhaps it’s time to consider a pharmacy benefits administrator that offers the following:

Who is Employee Benefit Advisors describing? Contact us and make a referral on your behalf.

Employee Benefit Advisory provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.

Don’t like lengthy waits to refill your prescriptions? Prefer to have refills delivered to your door? Prefer someone else troubleshoot insurance & renew refills for you? Let me introduce you to Phil.

Phil is a service that manages your ongoing prescriptions. Phil partners with top-rated, locally-owned pharmacies that are licensed by the Pharmacy Board. These pharmacies will deliver your medications to you on time and answer any questions over the phone. Using the Phil app, you are able to refill on your own terms by scheduling when your medications arrive, ordering vacation refills etc.

Welcome to Phil – Smarter Prescription Refills: same copay, free delivery and a real time saver.

Phil takes 3 easy steps.

Step 1 – Sign Up and add your existing prescriptions to Phil.

Step 2 – Phil does the rest, they contact your old pharmacy and do the paperwork.

Step 3 – Receive your meds. Partner pharmacies deliver meds to your doorstep every month.

All partner pharmacies are rated 4-5 stars on Yelp®

Delivery is free. Phil will guarantee your copay will be the same as what you pay at your current pharmacy. Some rare exceptions may apply; in those cases, you’ll be contacted for approval. If you don’t have insurance, Phil partner pharmacies will quote you the lowest price they can obtain for you.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services. We can customize a wellness plan for your budget and culture.