UnitedhealthCare has provided two videos covering the basics of IRS section 6055 and section 6056 reporting to help give a better understanding of what the reporting is and what is required of employers, both fully insured and self-funded.

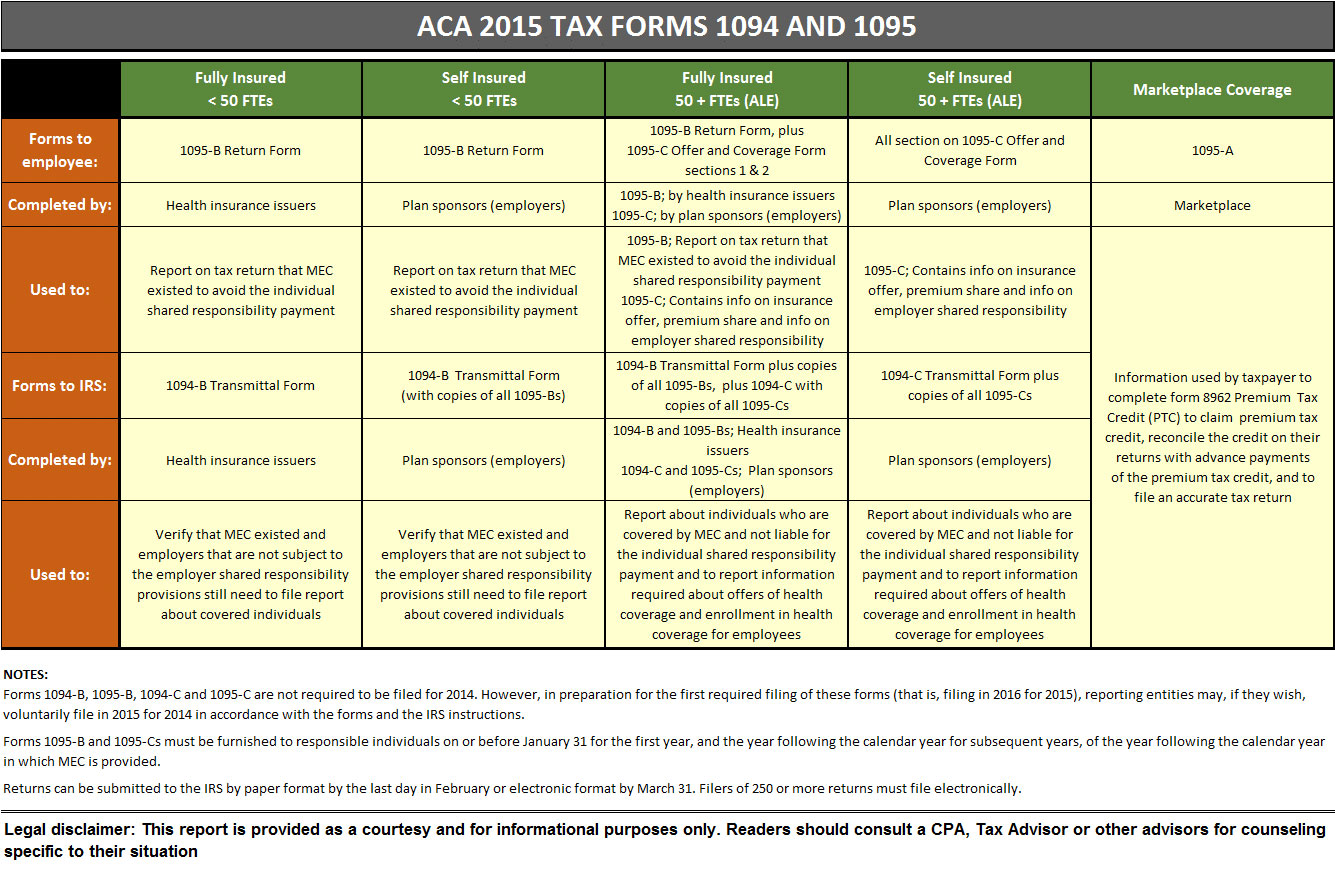

Section 6055 reporting supports the individual mandate. It is the required reporting to the Internal Revenue Service of information relating to covered individuals that have been provided minimum essential coverage by health insurance issuers, certain employers and other entities that provide minimum essential coverage.

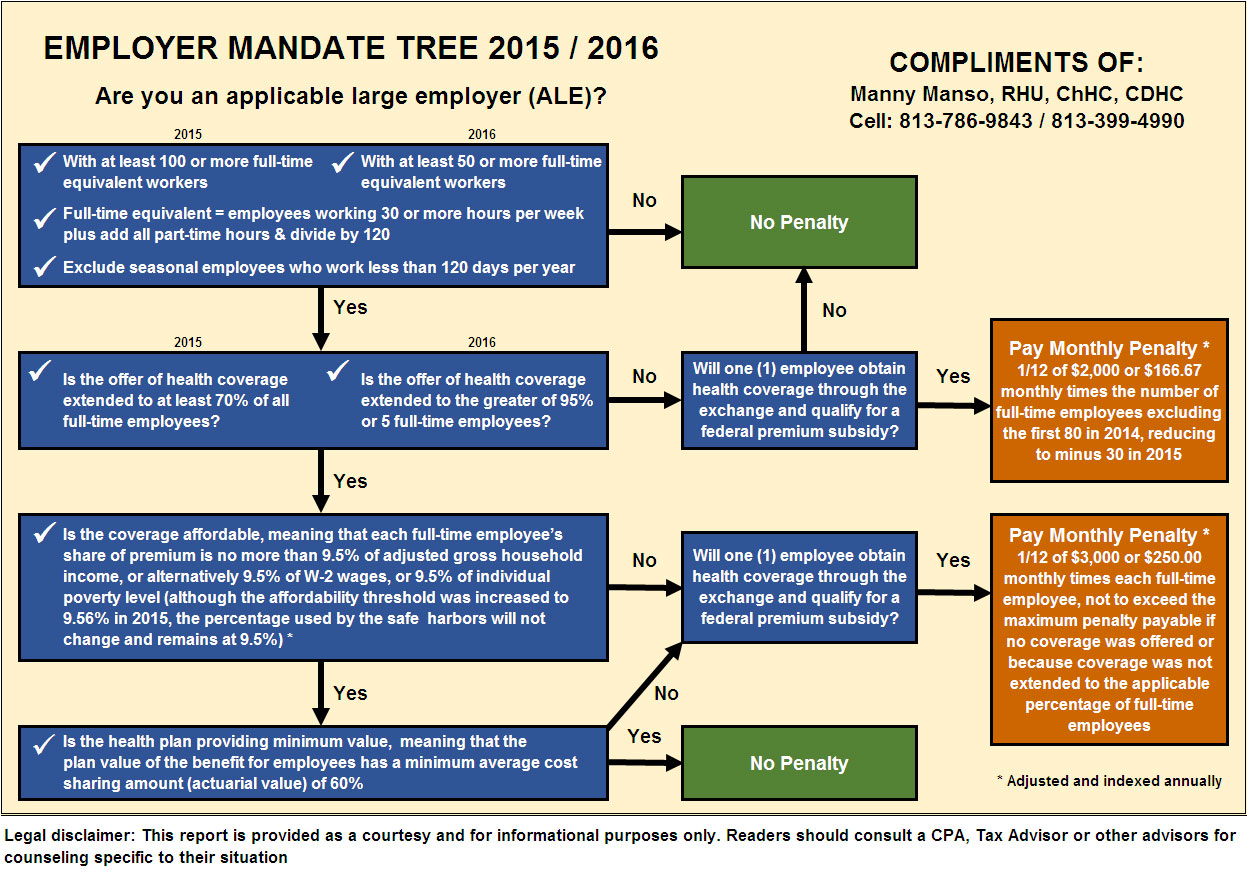

Section 6056 reporting supports the employer mandate. It is the required reporting to the IRS of information relating to offers of health insurance coverage by employers that sponsor group health plans.

Specifically, the videos cover:

- What are sections 6055 and 6056 reporting (click to view videos)

- When the provision becomes effective

- When reporting needs to be done

- Who is responsible to report

- UnitedHealthcare’s approach to supporting fully insured and self-funded groups

All content for this Blog was provided by UnitedhealthCare.

Employee Benefit Advisors provides employee benefits, tax-advantaged healthcare, compliance guidance for ACA and Health & Welfare DOL Audits, and PEO Advisory & Consulting Services.